tucson sales tax rate change

Effective July 1 2017 the rate will rise from 20 to 25 increasing the total retail sales tax rate in Tucson AZ from 81 to 86. Democrats and Republicans praise tax cuts in South Carolina.

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Please note that effective February 1 2018 the City of Tucson Business Privilege Tax Rate has increased one tenth of a percent to 26 percent.

. This change has no impact on Arizona use tax assessment which remains at 56. And if the gun is purchased within the city limits of Tucson that brings the combined rate up to 87 adding. On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No.

City of Tucson NOTICE TO TAXPAYERS TAX RATE CHANGES EFFECTIVE JULY 1 2017 As the result of a Special Election held on May 16 2017 Mayor and Council adopted Resolution No. The December 2020 total local sales tax rate was also 8700. TAX RATE CHANGES EFFECTIVE FEBRUARY 1 2018.

23 2022 in. For information on the changes and examples the Arizona Department. Tucson AZ Sales Tax Rate.

Tucson Estates AZ Sales Tax Rate. Wayfair Inc affect Arizona. Tax Inquiry Property Search Tax Payment Tax Statement.

The Arizona sales tax rate is currently. This is the total of state county and city sales tax rates. As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance No.

520 724-8341 Fax. Effective July 01 2016 the per room per night surcharge will be 4. 22760 to authorize a voter approved five year temporary half-cent sales tax increase to fund improvements for roads and public safety.

As UA is exempt from the collection of City of Tucson sales tax for sales made by the UA this change will only apply to purchases from Tucson vendors located within the city limits. In Pima County though add an additional half cent for the countys sales tax. Please complete and return this form for any contracts or projects inside Tucson city limits that qualify for this grandfathering.

This is especially important to note if you are an annual filer as the city tax rate has increased from the return filed for 2017. The current total local sales tax rate in Tucson Estates AZ is 6100. Tucson AZ Sales Tax Rate.

TAX LIEN INFORMATION TAX LIEN SALE SUBSCRIBER SERVICES. Effective July 01 2003 the tax rate increased to 600. This change has no impact on.

The form is fillable if opened in Adobe Acrobat or Adobe Reader otherwise it may be printed and. Tumacacori-Carmen AZ Sales Tax Rate. CURRENT YEAR RATE PRIOR YEAR RATE CHANGE IN TAX RATE.

Corona de Tucson AZ Sales Tax Rate The current total local sales tax rate in Corona de Tucson AZ is 6100. Michigan Income Tax Brackets and Rates Michigan has a flat tax rate of 425 for 2021 meaning everyone pays the same state income. 11518 to authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement Fund.

2021 Arizona Tax Rates Application Forms subject to change please verify prior to show start Tucson Arizona Sales Tax Rate as of Dec 5 2018 Combined Sales Tax Rate 61 56 state of AZ 5 Pima County Contact for State TPT Questions. Retail Sales 017 to five percent 500 Communications 005 to five and one-half percent 550 and Utilities 004 to five and one-half percent 550. The City of Tucson tax rate increased effective July 1 2017 from 2 to 25 for most business activities and increased effective March 1 2018 from 25 to 26 for those same business activities.

On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate. Tumacacori AZ Sales Tax Rate. Andy Beshear endorsed legislation to temporarily cut the state sales tax rate to take some of the sting out of.

Tubac AZ Sales Tax Rate. Effective July 01 2009 the per room per night surcharge will be 2. The December 2020 total local sales tax rate was also 6100.

Tusayan AZ Sales Tax Rate. The state income tax rate is 425 and the sales tax rate is 6. The House would increase the sales tax on most items other than groceries from 7 to 85 while the Senate would not change the rate.

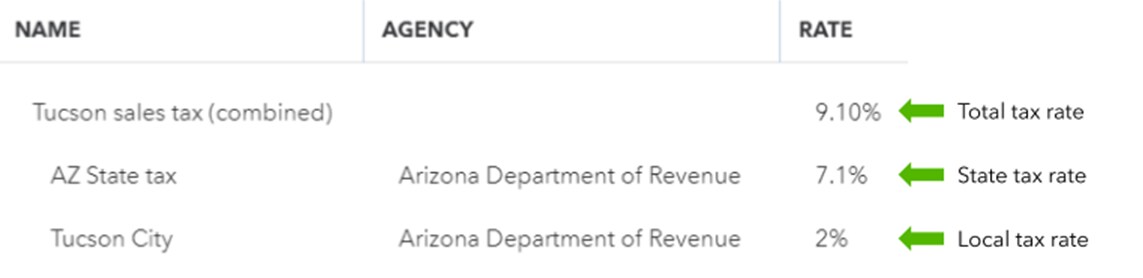

The Tucson sales tax rate is. 2021 Arizona Tax Rates Application Forms subject to change please verify prior to show start Tucson Arizona Sales Tax Rate as of Dec. 4 rows The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County.

240 North Stone Avenue Tucson AZ 85701-1199 Phone. The County sales tax rate is. The following are the tax rate changes.

Contracting Changes For Contractors doing Maintenance Repair Replacement or Alteration MRRA work During the 2013 2014 and 2015 legislative sessions the legislature made significant changes to how Arizona and cities transaction privilege tax TPT applies to contracting activities. The current total local sales tax rate in Tucson AZ is 8700. 19-01 to increase the following tax rates.

Did South Dakota v. The minimum combined 2021 sales tax rate for Tucson Arizona is. Regardless of when a contract is executed if change orders are executed on or after February 1 2018 they will be subject to the new city tax rate of 26.

Last week Democratic Gov. South Carolina House Majority Leader Gary Simrill R-Rock Hill talks about a plan to cut income taxes on Wednesday Feb. The December 2020 total local sales tax rate was also 6100.

License Compliance Phone 602 255-3381Toll-Free 800 352-4090. 5 2018 Combined Sales Tax Rate 601 56 state of AZ 5 Pima County Contact for State TPT Questions. License Compliance 602-716-6181 email.

Accordingly effective February 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in Tucson AZ from 86 to 87.

Where Do Arizona Residents Receive Most Value For Property Taxes Prescott Enews

Property Taxes May Move Into Suburbs Government Politics Tucson Com

Rate And Code Updates Arizona Department Of Revenue

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Arizona Sales Tax Rates By City County 2022

Sales Tax Rates In Major Cities Tax Data Tax Foundation

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

State And Local Taxes In Arizona Lexology

How To Calculate Sales Tax Video Lesson Transcript Study Com

Arizona Sales Tax Small Business Guide Truic

Arizona Sales Tax Guide And Calculator 2022 Taxjar

Property Taxes May Move Into Suburbs Government Politics Tucson Com

State And Local Sales Taxes In 2012 Tax Foundation

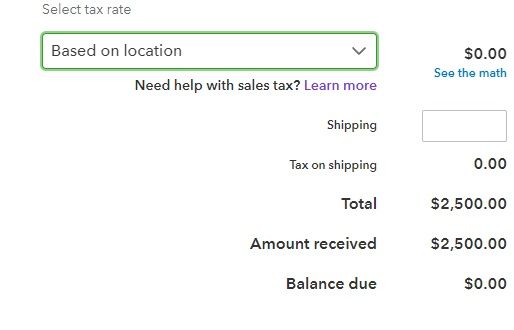

Solved I Struggled With The Automatic Sales Tax Setup No

How To Charge Sales Tax Vat With Samcart Samcart

Use Custom Rates To Manually Calculate Taxes On Invoices Or Receipts